by gabriel_sales | Jul 8, 2011

This is part one of a two part series that explains how being strategic in planning how you target customers will produce significantly better results on the back end. Part two can be found here,How to Build a Winning Ideal Customer Profile.

An Ideal Customer Profile is a process for identifying what customers you should be targeting to get the best return from your sales lead generation efforts. As an outsourcing sales organization this is one of the key areas we focus on when providing our initial sales consulting during the launch of a client. We believe this aspect of the sales process deserves careful attention because what goes into the sales funnel is going to have a huge impact on what comes out of the funnel. It is also the critical first step in building an aligned sales and marketing effort, so you can create a sales machine.

Ultimately, an Ideal Customer Profile should allow you to find and target your potential customers based on a number of hard criteria related to both the company and the specific decision maker:

- Annual revenue of the company

- Number of employees

- Level of Contact – C-level, senior Manager, middle manager

- Functional Area – business Area, technical Area

- Title

- Revenue Responsibility – budget maker or budget spender

- Geography – global, national, local

- Technology Adopted – in some cases knowing what ERP, CRM, and if they have virtualized may be critical

- Their Clients – e.g. are they doing business with a Procter and Gamble, Federal government, education (local gov.) Walmart, Intel, EMC etc.

In addition, there well could be some softer qualitative criteria:

- Business Pain/Need

- Vertical Industry Trend – established or in transition, growth or decline

- Competitive – large competitors or a volume of competitors

- Psychographics – company culture, leadership style, corporate values

It is also important to know who you don’t want to sell to:

- Decision makers whose jobs could be threatened

- Internal Support Functions – for example, if you are selling data analytics you may want to avoid MR groups, or if you are selling operational efficiency services you may want to stay away from operations managers and start with supply chain directors

The purpose of this type of hard and soft segmentation is to establish clear, hard criteria that can be leveraged across your sales and marketing machine to:

- Purchase direct dial contacts for cold calling

- Purchase direct mail and Electronic direct mail contact information

- Filter leads from publishers

- Leverage for a “Cost Per Click Campaign” like Google Adwords

- Decide where to place your online advertising budget

- Instruct your social media outreach program

We realize this can look like a daunting task. But, as an outsourcing sales organization with 10 years of data we can guarantee that if you give this the attention it deserves upfront, you will see significant returns within 6 -12 months. You will see exponential returns in months 12-18 when your first wave of nurturing deals start to fall out of your pipe as closed deals.

For additional information on how to build and Ideal Customer Profile, we recommend you check out our companion piece entitled, interestingly enough, How to Create an Ideal Customer Profile.

by gabriel_sales | May 24, 2011

As an outsourcing sales company, outsourcing lead generation company, a sales strategy consulting and a digital sales marketing execution company, we have a great deal of conversations with existing and potential clients about what sales and marketing alignment mean. For Gabriel Sales it means that you have a sales machine where your team is focused on closing business. That means:

- Marketing is focused on putting leads in the pipe that will close

- Marketing drives deals forward with the right sales collateral at the right time.

- Sales provides marketing with the insights they need

- Marketing provides “Sales Collateral”, that moves deals through specific stages of the pipe

- Sales will actually use the collateral

- Sales trusts marketing to do its job to nurture deals that are not yet ready to buy

The first step in building Sales and Marketing alignment is to agree on your Ideal Customer Profile.

The second step is to agree on definitions for early stage leads. You need to do this so you can build a lead generation machine that matches the buyers readiness to buy with the expectations of your sales team. This way they will understand how much time, effort and money should be invested. To do this you need to clearly define your lead generations and lead qualification stages.

The following are quick definitions that Gabriel Sales uses:

Marketing Qualified Lead (MQL) – A lead that has accepted information and is open to understanding what you have to offer. They have registered for an event, or engaged in conversation with a telemarketer and indicated an openness to be contacted again.

MQL Hot – They are actively digesting your content. They have registered for and attended a webcast. They are opening multiple pieces of digital content. They are asking your telemarketer buying questions.

Sales Accepted Leads (SAL) – There is a fit between the customer’s pains or needs and your product or solution. It makes sense to invest sales resource time to do some initial discovery. A telemarketer can identify this fit by asking some pain questions and then setting an appointment. A marketer can do this by noticing a shift in the content they are absorbing. Are they moving from digesting digital sales content that is educational to digesting digital content that is verifying content? Are they moving from opening emails onto white papers, case studies, testimonials or your blog? (This is why an investment in marketing automation software like Marketo or Pardot becomes critical).

Sales Qualified Lead (SQL) – Your inside rep has established the decision making process, budget and/or path to budget and confirmed the need, which includes some combination of the following:

- Vertical

- Public or Private

- Annual Revenues

- Spend in Solution Area

- Strategic Initiatives

- Contact(s) title and role(s) known

- Basic understanding of need/pain

- Spoken to lead several times

- Potential opportunity identified- product matched to pain

- Timeline identified 3-12 months (depending on sales cycle

- Stakeholders identified)

- Initial compelling event identified that drives the timeline

- Decision makers identified

- Agreed to meeting with “Senior Sales” or “Executives” and a next step beyond that meeting (even if that next step is a yes or no on moving forward)

Nurture – Not yet ready to buy. Have expressed interest, but have not shown an interest in moving beyond Sales Accepted Lead. In some studies and across several of our clients we are seeing as many as 77% of our deals coming from the pipe a year after we have made first contact. This requires we stay in touch with digital content and an occasional voice mail on a sustained and consistent basis.

Once you have agreed on the definitions it is much easier to give your marketing team a sales quota by evaluating their tactics and giving each tactic both a primary and secondary function in building sales momentum.

by gabriel_sales | May 4, 2011

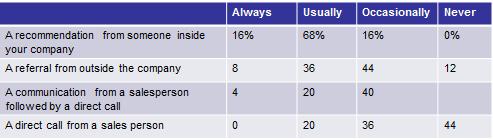

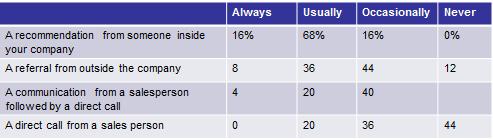

In Selling to the C-Suite Nicolas Read and Stephen Bistritz (page 84) provides some fantastic data that gets to some of the realities of what it now takes to get to the Senior Decision Maker. Below is what they found (detailed in the table), our strategic insight and how we approach the challenge of how to get a meeting with an executive.

Question – “When would you take a sales meeting?”

Answers:

Point #1

Strategic Take Away – You have an 80% shot of getting to the Decision Maker with an internal champion. You are almost guaranteed (4 out of 5 is as close to a guarantee as you will ever get in sales) a meeting if you can gain the trust and confidence of the technical buyer whose job it is to screen for the DM.

Action Item – Focus on creating content and a pitch that addresses the needs of the technical buyer first.

Point #2

Strategic Take Away – An outside referral works about 50% of the time.

Action Item – Success stories and on-record clients need to be part of your content and pitch mix. This also takes the pressure off of your technical buyer being out there solo recommending you especially if the recommendation is from the equivalent of a peer of the Decision Maker at a comparable company.

Point #3

Strategic Take Away – Just Cold Calling Senior Executive no longer works.

Action Item – A home run for Gabriel Sales has been getting very pointed video testimonials from Decision Makers. This allows your technical buyer to easily share them with the Senior Decision Maker.

We hope this blog has been helpful in understanding how to get a meeting with an executive. For more information, please contact us.

by Glen Springer | Apr 25, 2011

In 1997 one of the first sales jobs I had was for a Silicon Valley start-up called Autoweb.com selling websites and leads to car dealers. Some of you might not remember what it was like to buy a car prior to the internet. In those days you would walk onto a car lot and the only pieces of information you could access were the Kelly Blue Book value of your trade in and the MSRP on the window sticker (if you were really savvy you had Consumer Reports and JD Powers comparison and safety data). The typical sales person would then pitch the features and benefits and take you into a room to bust out what was called the “Four Square” http://consumerist.com/2007/03/dealerships-rip-you-off-with-the-four-square-heres-how-to-beat-it.html

Essentially the Four Square was a way to keep the car salesperson in total control of the sales process by allowing them to decide when and where they would share information. It was about obfuscating the information to close business. In the 90s buying a car was ranked just below a root canal and divorce as unpleasant experiences. Companies like Autoweb.com changed an entire paradigm and subsequently the buying experience because we made the price and features of buying a car transparent and accessible when and where the buyer wanted it. That’s not to say this was an easy model to get dealerships to adopt. I was cursed out and hung up on 100s of times by Dealership owners and GMs when they figured out what we were doing.

By 1998 car buying had changed. My Autoweb.com clients that adopted this model and embraced the new paradigm of transparency and service ended up seeing their sales increase in their markets by as much as 35% in a two year period. A fair amount of the businesses that hung up the phone on me ended up going out of business, literally out of business by 2000. This new way to buy cars was such a successful model because when you sold to the buyer the way they wanted to buy you won more business. What did the buyer want – transparency and not to be “hard sold” they wanted to engage in dialogue with an expert in a situation where they had as much information as the seller and control of the process.

In Where Good Ideas Come From Steven Johnson talks about the 10/10 rule for innovation. Where he says “it takes a decade to build a new platform and a decade for it to find a mass audience”. He also talks about true innovations coming from “adjacencies” – the connections of ideas and technologies in new ways to produce improved results and “innovative systems have a tendency to gravitate towards the ‘edge of chaos’: the fertile zone between too much order and too much anarchy. At Gabriel Sales we think that Steven Johnson is spot on. We are seeing…

- ….all the adjacent locations on the Internet – Websites, Social Media, Publisher Sites, etc. , the technologies of the Internet from YouTube, Go-To-Meeting, Webcasting Platforms, Slide Share, and the SaaS technologies of Saleforce.com, Mail Chimp and Marketing Automation Platforms, and Telecom Technologies…

- …and well trained telemarketing, telesales and outside sales reps….

- ….and marketers armed with analytics tools…

…as able to execute a complex sale B2B sale in the same way Autoweb.com was able sell a commodity to a single end consumer 12 years ago. By integrating all of these tools into the right processes —prospect teams (the people we are trying to sell to) responsible for buying can work transparently and seamlessly with sale and marketing teams (Gabriel Sales)— to create a mutually beneficial experience that is dedicated to helping buyers buy the way they want to buy. The rules of engagement have changed and 20 years since the inception of the Internet, the way we connect as human beings and sell to one another is now permanently changing. Always be closing (at least in the first stages of the buying cycle Awareness and Interest to stay with the Glen Garry Glen Ross metaphor) is no longer about “selling” it’s about transparently “serving and sharing” first.

by Glen Springer | Apr 11, 2011

The Right Integrated Pitch and Content Strategy – Ensures the Technical Buyer Does Not Say “No” so the Business Buyer will Say “Yes”

What we are sharing below is an abbreviated outline to give you a flavor of how to approach your sales content to:

- Ensures you keep the dealing moving forward faster

- Save you money by creating collateral that can be used across the sale

- Accelerate the speed to get the meeting with the Decision Maker

If you are interested in the full presentation let us know.

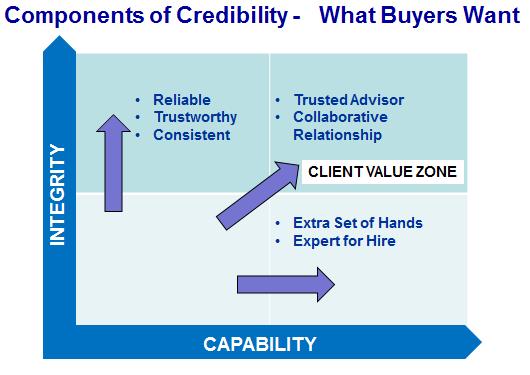

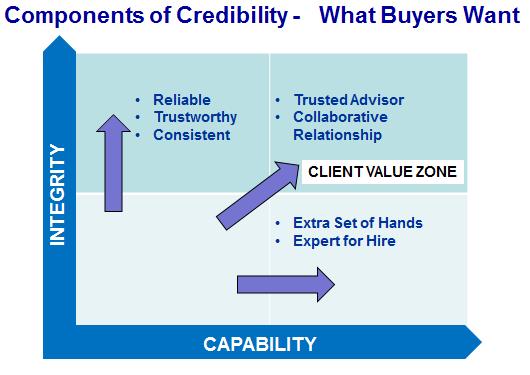

In Selling to the C-Suite the authors advocate that you need to pitch to C-Level Executives on your ability to be a “Trusted Advisor”. To summarize, from the execs position, the trusted advisor needs to demonstrate the following qualities:

1. Ability to Marshal Resource

2. Understand my Business Goals

3. Responsive to my requests

4. Willing to be Held Accountable

5. Knowledge of company’s products

6. Ability to solve problems

7. Works well with my staff

Trusted advisors end up in the Client Value Zone (below). You win business as a trusted advisor and most importantly it’s the right kind of business – long term and reoccurring. In fact we tested the list from this book against one of our clients closed deals and 8 out of the 10 of the deals we won were almost verbatim hitting points 1, 2, 4, 6 and 7.

So all that stated we obviously all want to be in in the Client Value Zone. We hear the battle cries with every new client we launch. “Let’s put together a pitch that gets us meetings with the top executives out of the gate.” “Let’s go big or go home! “ That’s a great strategy but its no longer totally grounded in reality . You need to sell to the technical buyer. You don’t get to the business buyer consistently unless you are skilled at converting your technical buyer into a champion and advocate.

At Gabriel Sales we generally advocate that you focus on the technical buyer first especially when it comes to content strategy because you can leverage the majority of the content you provide the business buyer in shorter forms with the business. This may sound counter intuitive and going after the technical buyer first is not quite as sexy, but it works, so indulge me for a couple of more lines.

Combining the two data points above -here are your traffic signals for selling to the technical buyer and why that content can be repurposed for the business buyer:

- Green Light – Definitely prove you are reliable, trustworthy and consistent to the technical buyer.

o Content and Sales Focus – A couple testimonials and keeping your promises while executing a methodical sales process will prove you have Integrity to the technical buyer and will also cover of on the business buyers need to believe you are willing to be accountable (criteria #4)

- Green Light – Prove you are a solid extra set of hands

o Content Focus- this is done with Success Stories and Case Studies. This will show the technical buyer you have the capability and will also demonstrate to the business buyer you have the ability to solve problems (criteria #6) and understand business goals (criteria #2)

- Green Light – Prove you are an expert

o Content Focus – Do this with educational webcasts, digital demos and solid ROI examples. This will prove your expertise to the technical buyer and will also prove to the business buyer your sales and marketing team know their own products cold (criteria #5)

- Red Light – Never claim to the technical buyer you are an expert in their companies business or overtly tell technical buyers you will be a trusted advisor and have a collaborative relationship.

o Content Focus – Wait until you have a meeting with the Executive Buyer and have video testimonials that are gated where your own customers make this claim for you. There is one exception here – if there are specific areas where you need or can make and support the claim that you are an expert in a discrete area of their business (ideally around a sales objection) have a customer go on record to support that claim. Ideally with a digital testimonial so you can control it. These testimonials if done correctly will cover off on criteria #1 (your ability to marshal resources) .

Why is this guarded pitch and content strategy more important than ever? 2 reasons –

If you blow through the Red Light and THE TECHNICAL BUYER WANT TO BE A TRUSTED ADVISOR TO THEIR EXECUTIVE TEAM OR BOSS you will never get that meeting — because in these economic times of 8% plus unemployment – “Trusted Expert Advisor” could mean the technical buyers job (if they are not super confident) or “Trusted Advisor” could mean “I don’t get a promotion” to the technical buyer. In either case you don’t know what you don’t know (especially early in the sales process) so it’s better to err on the cautious side. Don’t give the technical buyer a reason to say no and you get your shot at the business buyer to say yes.

Finally if your pitch and content are properly aligned and you do your job with the technical buyer and you get that intro you will cover off on the business buyers criteria #7 “Works well with my staff.” Executed correctly that makes you seven for seven in business buyers “Yes” criteria before you even get to the Decision Maker – which at the end of the day is the technical buyers job as the gatekeeper. Show the technical buyer respect and consideration and you are going to win more than you lose.

If you would like Gabriel Sales to help you create a content strategy to drive results for the technical or business buyer, please contact us.

by Glen Springer | Mar 18, 2011

Aligning Your Sales and Marketing Funnel starts with measurement and metrics because for operational excellence you need to set base lines. In terms of aligning sales and marketing this is especially true for three core reasons:

- It makes all the “play” very “real” by creating a scoreboard

- Your sales and marketing folks start functioning as a team instead of in silos because they have a shared goal

- You improve what you measure – it drives innovations

Making the Game “Real”

We have all watched kids at play. Take any 10 years-olds basketball game. Before the game everyone is laughing and having fun but as soon as that referee blows the whistle and the “game” starts that 10 year old’s effort and intensity increase. What has changed? One thing they are keeping score. The same effect occurs when you give your sales and marketing teams have a shared scoreboard. The only thing that counts at a kid’s soccer game is scoring more points than the competitor. The only thing that matters in your sales efforts will be closed deals.

Removing the Silos

Once you have given the shared goal of closed deals to your sales and marketing team everyone starts contributing to that effort with one focus – to do their part moving deals from one stage to the next. Everyone focuses on closing the next step. And like a kid’s basketball game everyone starts looking at the leading statistics. In basketball it’s going to be assists, fouls, rebounds etc. Everyone can get accolades for doing their part. In sales and marketing you will want to look at:

- Touches to Accepting Information

- Accepting Information to Marketing Qualified

- Marketing Qualified to Sales Accepted

- Sales Accepted to Sales Qualified

- Sales Qualified to Proposal

- Proposals to Close

What ends up happening when you are keeping the common scoreboard focused on closed deals more lead volume is not as important as quality of leads. More time is spent of qualifying deals before they are transitioned. Marketing focuses on pipe velocity as opposed to branding. When you are keeping score the relevant statistics all become focused on improvement towards a common goal – Closed Deals!

We also generally find that the entire sales process becomes more fun for the “Aligned Team”.

You Improve What You Measure

The end result is that you start driving efficiencies in your Pipe’s Velocity. Better Pipe Velocity Means More Time Spent Closing Deals! The team becomes more focused on improvement rather than being territorial.

Let’s take one example. We had a client that we had no problem getting deals in the pipe for. We had no problem taking them to proposal. That’s where deals stalled. The Marketing and Telesales team were doing a fantastic job with their specific responsibility of filling the pipe. But because we were all focused on the closed deals and measuring the pipe velocity the senior sales reps understood that if we got a prospect into a specific face to face meeting explaining the clients technical chops to their SVP of Supply Chain we won 75% of those deals. Marketing took that insight and created an abridged digital presentation that could be shared earlier in the sales process with the technical buyer to share with the SVP of Sales. Telesales then took it upon themselves to ensure that before we called a client Qualified our technical buyer needed to share that with his SVP of Supply Chain before we would scope the proposal. Because we were sharing it digitally we knew if the SVP of Sales consumed that content. When that content was consumed is when the enterprise sales rep and the professional service lead on the client side would take over the sale.

The end result was we lost deals earlier in the funnel because we discovered if they were a “true” fit earlier because we had that digital dialogue with the SVP of Supply Chain (the business buyer). The volume of the pipes Sales Qualified Deals decreased by 50% but the closing rate increased by 3X. This saved everyone in the food chain time and consequentially saved the client money. This equated to more revenue at less cost. Over time net result was that because we worked as a team we were actually able to invest the money saved on the backend (wasted enterprise reps time spent pursuing deals that were not going to close) and we were able to put more deals into the front end of the pipe for a net gain of 4X the revenue at the same time.

Everyone won. The client had more deals. The sales reps experienced more success and the technical buyer was given the tools they needed to save themselves countless hours scoping a solution that their company was not yet ready to buy. The beautiful long term output is that a year later some of those SVPs have now changed their mind and are circling back because they are ready to buy. We can guarantee that without detailed measurement of the pipe’s velocity these short term and long term gains would never have been realized.