Customer Background For Writer – FRU

Finance.Risk.Unified. (FRU)

About FRU

Finance.Risk.Unified is a joint offering between two businesses:

- – OnPoint Risk Advisors Consulting Company

- – Sola Analytics Technology Company

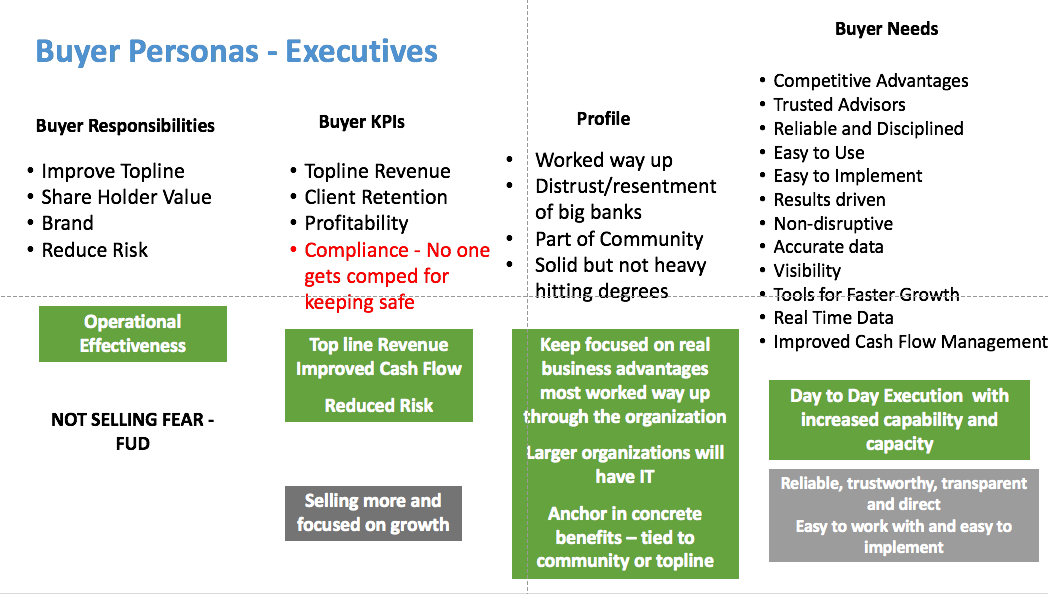

Audience

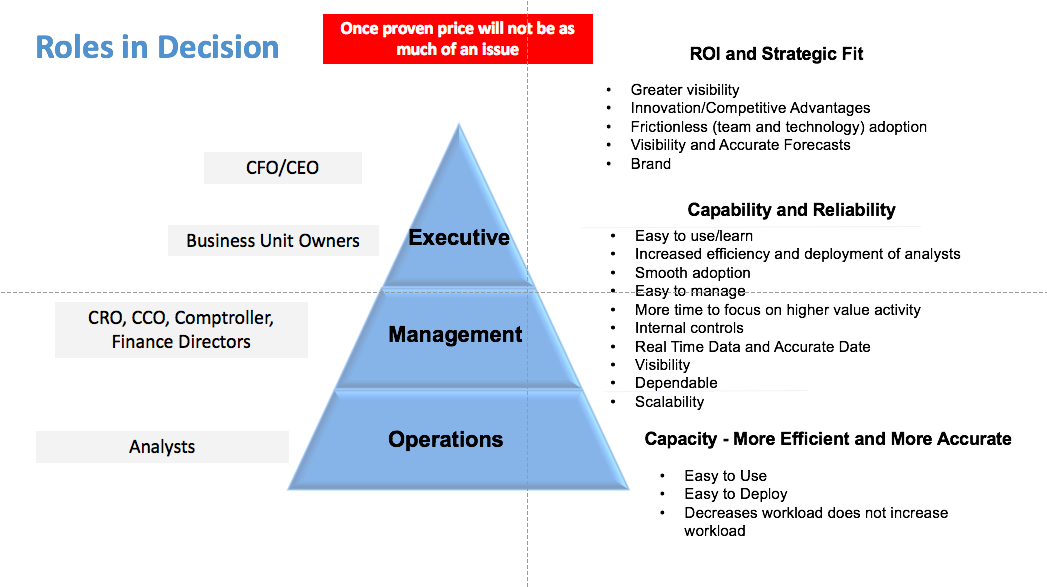

FRU sells to C-Level Executives in Community and Regional Banks. Including

- CEO

- COO

- Chief Risk Officer

Here are their hot buttons:

Style

Professional and straightforward . Not salesy at all.

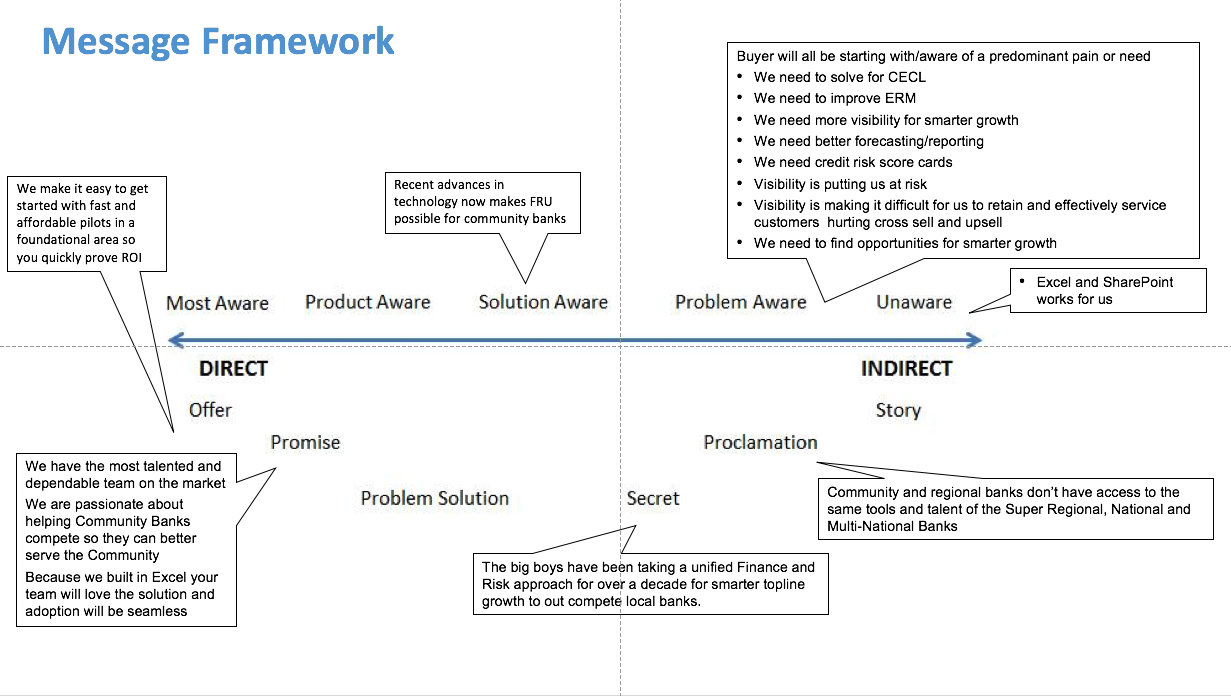

Our Approach to Building Value Props

Is the problem unworkable? Does your solution fix a broken business process where there are real, measureable consequences to inaction?

Is fixing the problem unavoidable? Is it driven by a mandate with implications associated with governance or regulatory control? For example, is it driven by a fundamental requirement for accounting or compliance?

Is the problem urgent? Is it one of the top three priorities? In selling to enterprises, you’ll find it hard to command the attention and resources to get a deal done if you fall below this line.

Is the problem underserved? Is there a conspicuous absence of valid solutions to the problem you’re looking to solve? Focus where there’s whitespace, not scorched earth.

Value Proposition

We are a fully integrated software and services solution that specializes in helping community and regional banks grow faster and smarter with less risk. To do this we unify financial analytics, risk management and credit risk to provide banks like yours with the tools, technologies and methods that have only been available to the large banks at cost that you can afford.

We integrate financial reporting and risk management into one technology platform for greater visibility and one version of the truth for faster, smarter and more accurate forecasting, credit risk management and insights for top line growth.

Our team of real community bankers with proven track records successfully growing community banks and deep successful experience in the art of strategic risk management programs for community banks customize your solution to meet your financial goals and growth targets.

We customize your solution to meet the needs of your company culture and your community.

So you can make smarter growth decisions and deploy mature and more competitive risk management programs for every area of your bank.

We are the first and only solution to offer a unified finance and risk management software and solution designed specifically to help community banks gain competitive parity to compete against larger banks.

We are community bankers helping community bankers. Our team has a proven track record and decades of real world banking experience. And most importantly we understand growth. Our team delivers the same strategic, forward looking financial and risk management solutions larger banks have leveraged for over 10 years to provide you with the visibility and increased agility you need for smarter and faster growth.Our solution is unified but our deployment can be scaled. Pay for what you need when you need it. We make it easy to get started so you can tackle your most high impact areas first (mot pressing need or challenge) fast and affordably. Our solution includes modules for both the finance and risk management functions including:

- Budgeting & Forecasting

- Financial Reporting

- CECL-ready Allowance modeling

- Profitability analysis

- Enterprise stress testing

- Credit risk management

We understand community bank workflows and culture.

Because all we do is help community banks we deploy our solutions and best practices in half the time of any solution (risk management or budgeting solution)in the market today.

Our software end user interface leverages Excel so its easy to deploy, easy to learn and easy to scale

This makes the risk management and financial reporting process fast and easy so that you and your team can spend more time analyzing the results and less time producing reports

Our solutions are flexible and are customized to your workflows and specific product lines